What dangers face someone who makes an unlivable wage?

Can they thrive while they survive them?

Well…

I once wrote:

“Piercing blue and ominous amber lights encircled and filtered through the rolling plain. A row of dotted scarlet taillights etched into the landscape like lights on a house at Christmas. These streams of color added décor to the otherwise bland state highway.

I looked deep into the maze of red lights and realized something profound. This crash scene held my epiphany in regard to a living wage.

This vision was enriched with symbolism. Each part helped me understand and to confront the challenge of unlivable wages. A meaningful career that paid well enough to meet the complex needs of my growing family was my twenty-first-century enigma that moved past the concept of a living wage”

Today as I grow older, I’m still baffled why I’m in this situation. I have two college degrees and extensive vocational training. Yet no one has given me the nod to come and work with them for a living wage.

As a result, my wife calls us the forced minimalists. If I could pronounce forced minimalists, I’d start a YouTube channel and share our adventures as a couple. But you try to say the word minimalist correctly on-camera. So, a blog post will have to do.

Here’s how both of us as forced minimalists learned to as my wife says,”make poor look good” without a living wage. How do you thrive psychologically when you’re in this mode of survival?

Listen up.

What’s an Unlivable Wage?

In order to understand what an unlivable wage is you must first define a living wage.

A living wage is an amount of money per hour someone would have to earn to meet their basic needs of food, adequate shelter, childcare, healthcare, transportation, clothing, other necessities, civic duties, and broadband.

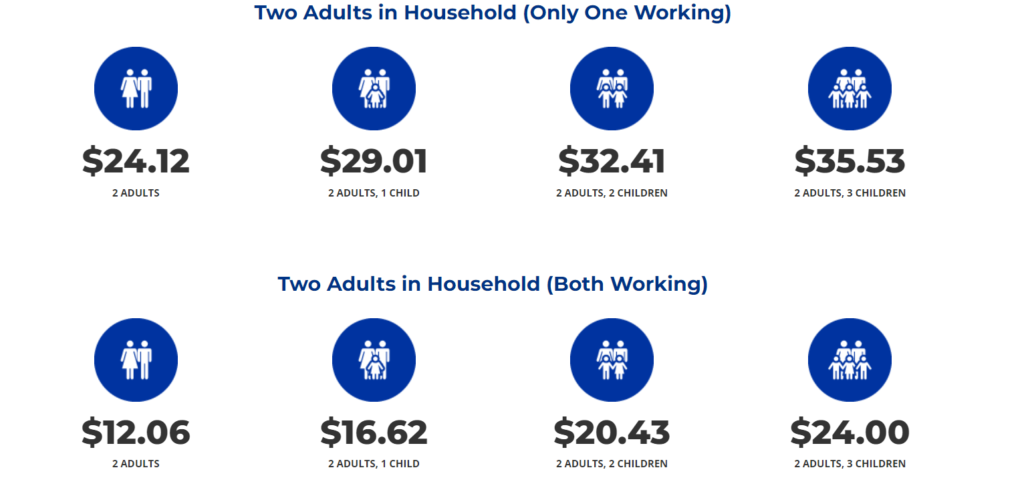

The living wage in Dallas, TX for one person $15.21 an hour for forty-hour week employment as of 2020. If children are added the wage goes up. Two adults working full time, the amount moves down to $12.06 an hour for forty hours.

There’s no doubt this average has increased with the inflation we’ve experienced so far in 2022.

When I worked at the college as a part-time instructor, I lived on an unlivable wage. Later as a bank teller, I continued this trend.

Life under the restraints of an unlivable wage is enough to make anyone a mental case. I survived although I took jobs both below and above a living wage. This is a handbook to show you how you too can be a forced minimalist and survive monetarily and psychologically on unlivable wages.

So, put yourself in my place. You’ve just lost your job or suffered an employment loss. You have skills, but they aren’t considered valuable by employers who pay well or recruiters that find their prospects high-paid opportunities. To learn more about how to overcome this issue, check out this.

Above All, Tackle the Monetary Issues

Budgets are now a must. Therefore, you must take down the most debilitating expenses. First of all, these include owed credit card balances. The next item that takes your cash away is adequate housing. The last financial domino to topple is transportation.

How to Slay Your Top Financial Giant: Credit Card Debit

Eliminate Your Greediest Financial Foes

First, you must learn to rethink. There’s a difference between the maintenance of life within your lifestyle and life above your lifestyle. You need to see that the difference between the two cultures is the frail bridge of your credit cards.

When you make an unlivable wage, you must blow up that bridge.

Where you eat, sleep, the car you drive, the quality of clothes you wear must be reevaluated.

In reality, experts recommended observation as the strategy to see what needs to stay and what needs to go in your lifestyle. Often, they suggest the pencil and receipt methods or others that include technology. Track every penny you spend for a month.

Once you’ve pinpointed your expenses, you must ask yourself the hardest question that even economists can’t answer anymore. That is– what do you need? I mean, without a doubt need to survive. Well, you’re in luck, the livable wage has the priorities already mapped out.

- Place to stay

- Food to eat

- Clothes to wear

- Transportation

- Medical care

The formula reads:

Basic needs budget = Food cost + child care cost + (insurance premiums + out of pocket health care costs)

-Dallas College, 2021 Statistical Study on Living Wage

+ housing cost + transportation cost + other necessities cost + civic engagement + broadband

In general, you need help, if any of these expenses are taken care of by a monthly credit card charge, you need help.

Credit card counseling is one avenue to get that help and get your payment per month down. Other options include direct contact with the credit card company for settlement arrangements and eliminating the expense charged each month on the credit card.

To decide the latter, you must make arrangements with family or friends and defer the cost of this basic need.

Think Outside the Norms

- Can you move down to one car?

- Live with friends or family?

- Sign up for government healthcare?

- Give up giving gifts to your spouse?

- Limit date night to free or low-cost alternatives?

- Homeschool your children?

- Buy second-hand items (clothes, furniture, electronics, etc.)

Once you get your expenses down to the bare minimum, you can bum-rush the giant.

Debt-Elimination Strategies

There are many debt-elimination strategies that include some form of stacking talked about below. These carry strange names that unravel both in dramatic and subtle scenes like an avalanche and a snowball fight.

Stacking Strategy

This is by far the most referenced and popular path to debt elimination.

What is stacking?

It’s similar to the debt avalanche strategy. Stacking is a credit card strategy for rapid pay-off debt with the use of a zero percent interest rate option.

Execution of the Strategy

- First, transfer the highest amount owed onto a credit card with a one-year zero percent interest rate (Important do not under any cases use this card)

- Secondly, pay all creditors that don’t have the highest amount owed their minimum payment amount

- Third, pay the debtor with the highest amount the most you can that is allowed by your budget (Some call this the slamming strategy.)

- Finally, continue to follow this financial payment plan until the top debt without interest is paid off

Once this highest debt is paid off, you move on to the second-highest amount owed and start the process over.

In summary, if you get to a point in the year, where you know you can’t pay off the balance in a year, you must move the balance again to a new creditor who offers zero percent financing. This is a modification of the debt stacking principle.

Grand Slamming Debt Strategy

What is the grand slamming debt strategy?

This is a debt payment strategy that takes any influx of money regardless of the source and uses it to pay down the creditor with the highest balance owed. In addition, it also means you use this method in combination with the stacking strategy.

So, you continue to first pay the highest balance owed each month and you pay this creditor the highest amount budget-wise that’s possible.

Thus, anytime you receive money, you use it to pay off your highest balance with it. This means you abandon the idea of only monthly payment intervals. Rather, you send money to this high-ball creditor at all times throughout the month.

Slamming Strategy Execution

Like us, you can use your income tax return to pay down this debt.

- The inheritance when your great aunt passes

- Escrow overpayment checks in the mail?

- Pennies on the sidewalk you find on your walk?

Do you know where they’re headed? Each windfall has your creditor with the highest balance’s name on it.

- Your market research survey payment:?

- Birthday money?

- Anniversary money?

- Christmas bonus?

Bingo! Put ’em in the mail and pay off your balance faster. Slamming also refers to when you pay the most your budget allows for to the creditor that owns your highest balance.

The case study that shows it works!

In 2008 we owed over $25k in consumer credit card debt. At that time, both of us had full-time positions and carried a monthly mortgage payment of $890. Our annual gross pay amount was $75K. When I was forced to resign in 2010, we consolidated our expenses with a move into my spouse’s parents’ home.

Without many options for space, we sold a great deal of what we owned or gave it away. We also continued to pay rent to her parents, supply our own food, medical insurance, daycare, and insure both our vehicles were paid off.

By 2014 while putting myself through college for a Master’s degree in Education, we had our debt paid off. At that time, we were officially credit card debt-free. To celebrate, we gave ourselves a big pat on the back and put new tires on the Honda. Our view of money and lifestyle was transformed. We had become a forced minimalist.

It was then that financial tragedy struck again when my college instructor contract ended without a vocational safety net. Unlike what we had been promised, a permanent full-time instructor position did not open. All of a sudden, we had only my spouse employed and still remained restrained by the constraints of an unlivable wage.

The psychological battle plan with the unlivable wage unfolded.

Insanity is doing the same thing over and over and expecting different results.

Unknown, falsely attributed to Einstein

Psychological Fight for Survival on an Unlivable Wage

Acknowledgement Phase of an Unlivable Wage

First, you must learn from the matter of your loss.

Poof! Reimagine the car crash.

Call on the debris and circumstances surrounding the accident. Yes, presently, I suffer from a lack of paid employment or a void of opportunity to earn a living wage. Before this, I struggled with unlivable wages and underemployment. I don’t know whether unemployment or underemployment is worse.

There’s a depth in the problem of life under a livable wage level and vocational unfulfillment. As I look at the pieces of the disaster of homelessness, I hope to find the strategy for action. I pray for the solutions to come through my study of this twisted configuration of materials.

It’s all there. Unbend the tools of interpretation and you see it all in the picture. First, shine the Maglite beam on your emotional impact. These rays bring forth new psychology in the form of a group of questions. Next, there are the physical tests of character and the physical body. These point out guesses at a resolution, and the belief in the presence of a hidden practical and spiritual plan of action.

This works with unlivable wage life or any challenge with loss.

Emotions to Follow Underemployment Wages

First, don’t fight the emotion. For a brief moment, get caught up in it like you would in the sensationalism of a news story.

How did it happen?

- See the shards of glass sparkling on the cement?

- The dead bodies?

- The injured victims?

- Onlookers attracted to your grisly sight?

Traffic jams bring up images of slow head-to-tail light movement.

You’d think there must be a game, a concert, or something popular, but not a wreck. No, that brings different images to mind. That’s why they call it a dead stop. It’s a possible, fatal accident.

You see, if you look at all these details in your circumstances and add high doses of emotion to them, and stir, you’ve created an image that can take apart your most powerful of dreams.

Second, if you dive beyond your fragile desires, you meet with your emotional side. A tangle with your raw emotion helps you to better understand the threats unseen wrapped up in this treacherous unlivable wage situation.

Perspective Game of a Living Wage

But beyond everything else, you need some distance from the loss of the livable wage. So, put on the mind of a professional working an accident scene.

First, Emergency Medical Technicians or EMTs clean up the accident. This priority restores road safety. This is your left brain in paradise. Crisis gives him the reins to your life’s direction.

Next, put on the boots of the crime scene investigator. Direct your energies into your power of thought. You must see the problems of llife below a living wage that you face both through the eyewear of inductive and deductive lenses.

These two ways of thought help you understand why you suffered this loss of income. What were the hidden causes?

Accountability is necessary during the acknowledgment stage. Sort through possible motives. These help in the goal of wage earner accountability. Yes, in this exercise you will be held liable for your actions as well as your lack of actions.

Aims at Acceptance of Unlivable Wages

First off, when the tragedy of unlivable wages strikes, you have to accept the income loss. It has and will create a fault line within the family unit.

Move past this. There’s no value in regret or delay to bypass losses. The goal of a review of the circumstances is prevention, not guilt. Thus, strategies need to be put in place to allow the future safety of everyone in the family.

Clean Up the Wage Spill

Next. Well, look, it’s your turn to mop up your unlivable wage loss scene. Undoubtedly, you zoom past the acceptance that something tragic has happened. But you need to embrace the tragedy as a child would. Become aware of your fragile nature.

In other words, be gentle.

Third, tell yourself where it hurts. Deceptive fear creeps into your consciousness, but failure is hard. There’s real pain here. To feel it, is a big part of your recovery process. Understand this. Let this disappointment shock you.

Then, choose to shift beyond thoughts of regret. “Life,” as the Desiderata, an ancient, inspiring, devotional text, explains “is unveiling as it should.”

Last, as the great jazz musicians say, there are no accidents. Each event has a lesson and a seed for growth within it. Life below a living wage is not exempt from lessons.

Beware. Pain and fear speak with a sharper voice than wisdom. From which of the two, fear or faith will a scream come from?

New Eyes on Income

Know Your Limits of Influence

There are two ways to think about the events surrounding a failure of an unlivable wage. The first is to embrace acceptance.

Things happen. You cannot control all of them.

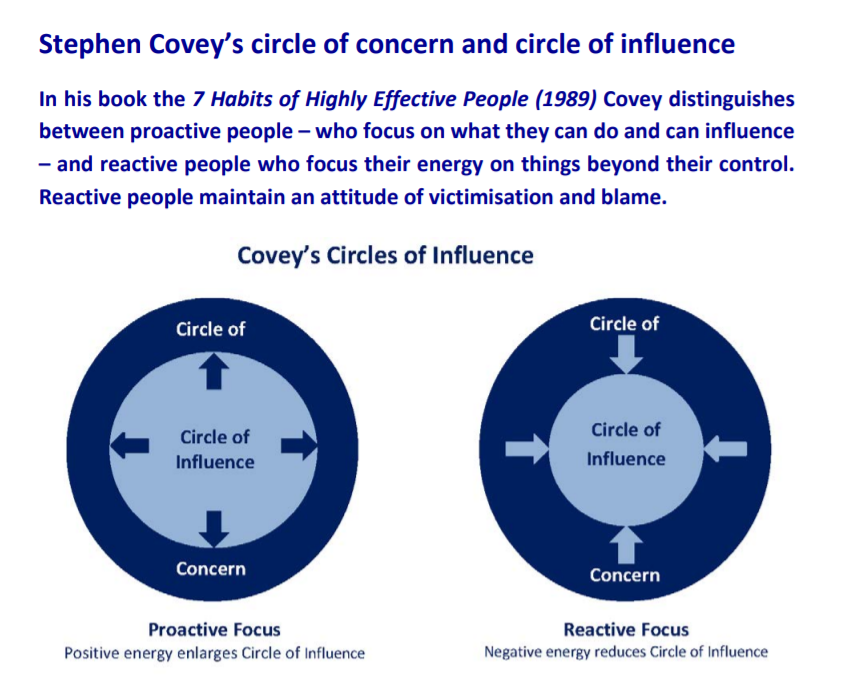

Two, they may be out of your circle of influence and circle of control, as Dr. Covey explained in his book The Seven Habits of Highly Successful People.

In brief, you can work on your skills and habits, but you can’t control if someone gives you a crack at a new opportunity. Nope, you can only make opportunities within your control happen.

The outcome that follows after your seized opportunity passes and how it’s received is beyond your circle of concern.

Growth Mindset Through Unlivable Income

Now, a growth focus is the second method of the process through this failure of the hunter’s net of unlivable wages. Listen to your instincts. They tell you that you can overcome the adversity of inadequate income.

Above all, this prize is emotional growth. That is your reward if you keep positive and stay away from the judgment of others. Naivety is the refusal to look at your cards when your subconscious deals from your deck of comparison.

Do you know what I’m talking about? There’s a voice inside us that asks, why don’t we have this person’s salary and their wonderful, new SUV they have in their driveway? Don’t I deserve that too?

If I can let go of the need to compare and focus on my growth, failure to earn a living wage is no longer a failure. These two thoughts form angles that combine to lift you off the ground and give your spirit buoyance.

This is especially true when you begin to doubt your progress toward the goal of gainful employment.

Plus, through the expression of constant gratitude, you’ll place your spirit in the hands of a universe that cares. A place that can help heal you through positive energy. But positivity is fickle. Any negativity will destroy its gains.

You’re like a water pail. You can only carry one liquid from the well. Light or darkness. Judgment or acceptance.

Third, abandon the desire to blame others for your misfortune and refuse to tear yourself down because of unlivable wages. Both uses of energy, channeled into blame, condemn and interfere with your growth.

Nuts and Guts Under an Unlivable Wage

Next, while you concentrate on your personal growth toward a healthy wage, dig in deeper to find out what makes you tick. In this space of nonjudgment, when you stand in this boundary, you have the most chance to see the cause of the accident of unemployment.

- Why did it happen?

- Who applied the brakes? When?

- What were the motivations or distractions present before the failure?

For example, my wife and I talked about why we are at the moment homeless. On the long ride home from her work today, we looked back at the decisions we made that seemed harmless at the time. One by one they added up.

- She worked fulltime and choose not to finish her Associates degree. (The first decade of our marriage).

- I took a job that took most of my time and put me at a school far from home. (I should’ve never taken a job with a fifty-minute commute. Geez!)

- We moved out of our apartment and into a house fast. Perhaps a better move would’ve been an upgrade to a two bedroom when it was still the two of us.

Uproot Fear Behind An Unlivable Income

Also, I listened to the noise of the fear of poverty that surrounded me. This was the belief that someone has to do crappy work in order to get to the good work later. Poverty is not only about life with a lack of money. It is also a lack of belief in the abundance of the universe to take care of us.

As crossroads of decisions such as the choice of a universe ruled by scarcity or generosity, you should become focused on objectivity.

You must look at the carnage of the wage tragedy, measure the tread marks of what was misunderstood, and think on all the unconscious motives before an attitude of scarcity triumphed over a belief in the universe’s abundance.

If both attitudes are accepted these two collide to kill your dreams.

Now, stop and reflect on your past vocational adventures and outcomes. I spent a decade and a couple of semesters in secondary teacher roles and each ended in disaster. Three different schools equal three similar results.

Remember the insanity quote? That was me! Is it you?

When I peer back into the cracked, rearview mirror at one of the vehicles of desire, what I see frightens me. I catch a glimpse of clarity in my position as a community college professor. I felt ready for it and more.

Doubtful Attudinal Differences Behind Unlivable Wages

Why did this college professor position end?

I couldn’t answer.

My self-confidence was clouded with doubt.

Could I succeed in a job outside of higher education? I wasn’t sure. So, I settled on a job that paid an unlivable wage, so I could continue to work.

My part-time teaching job at the college didn’t meet my family’s needs. This was especially true after the full-time gig ended. Later, I thought this new opportunity at the bank would provide enough income to balance out our budget spreadsheet.

After all, I provided for my family. I earned the pay necessary to meet their basic living expenses.

But I didn’t. Hours got cut. Affordable housing dodged us once again and left an unlivable wage in my hands.

Unlivable Income Fools

Then, my instincts refused to wait.

There was a fear of resistance to a new career path. So, I settled with a temporary fix, again another decision to earn an unlivable wage.

But that didn’t lead to a long-term solution.

It got me soo busy. Have you felt that in your situation? Pay attention to it.

For long, hard hours and less money than it took to survive, I worked. I would choose to ignore the inevitable effects of my decision as it spilled into a slow financial drought.

I knew this was a short-term gain, but I thought with a raise in pay that this wouldn’t come with a long-term financial sacrifice.

Therefore, the consequence of my decision, if I went off on a serious, talent-centered job search, was a long financial drought. Who knew how long this would last?

Yes, the bank position would give this family financial oxygen. Does your dead-end position give your family temporary financial oxygen?

I hoped I could rest and breathe before the bon-voyage of the ambiguity of a post-millennial career search. It shocked me that this brief stop to catch my breath would turn into three years of a dead-end job.

Energizapped into an Unlivable Wage

The splattered wreckage of the once shiny, potential of a job of better pay had pinned a victim. Now, I was stuck in an unlivable wage-tied job nobody wanted. Plus, by the end of each evening, my energy was zapped.

There was a psychological weight of an unpredictable workweek.

Combine that with a fickle boss, and a sense of underemployment tugged hard on me.

This was especially the case when taken together with my other full-time job as a homeschool teacher. This was a four to six-hour first-shift schedule. My high-functioning autistic son would have the chance of mastery in the lessons of his private school curriculum.

I believe the lack of paid time off for holidays and weekends without my family wore on my mental toughness. When I got home each night, I had no desire to search for better jobs.

I deluded myself.

I reasoned the basic skills of this job would lead to a better one. But there were no better marketable skills at this position than I had known as a public educator.

Yes, I was unemployed, but my motivation to work for this company stemmed from fear. And I haven’t ever had fear motivate me to keep a job and have it work out. Fear always numbs its victims. Has it numbed you? Why?

An Unlivable Wage and It’s Jaws of Life

The demolished bent steering wheel of an inadequate income had trapped another victim.

- I was afraid of the potential income loss from an in-depth career search

- I was afraid of the scars I would leave on my marriage as a husband who couldn’t provide.

Then, my wages dropped below unlivable. All that I had fought for was a livable wage. Unable to get one for my loved ones, I suffered a blow of annihilation to my ego.

To me, the company’s decision to cut hours backfired. The corporation attacked the fear of loss that was at once my motivation to stay. I thought about an exit. There was little incentive for me to continue this unlivable wage of $13.50 an hour and less than 40 hours a week.

Einstein’s Right: Link to Unlivable Wage Levels

This is when I discovered the power of a focus on personal growth as an unlivable wage earner.

My neurological program runs best when I focused on how I can get better character-wise and skill-wise each day. That’s where I work with the most efficiency. Then, I made another mistake. I met with my boss and told her of my desire to leave.

She convinced me to return. I let fear combined with the ambiguity of a directionless job search override my better judgment. Dazed, I continued in my role as a bank employee. Unaware, I lived out Einstein’s warning.

“We cannot solve our problems with the same thinking we used to create them.”

Attributed to Albert Einstein

Einstein’s message seemed, at first, negative. But it wasn’t.

No, it’s exciting to think about life situations from a different viewpoint.

Maybe I should take my education and experience seriously. I do have a unique set of stable, vocational skills, even if they aren’t in high demand. These soft skills do profit companies. For one, they help me get along better with coworkers and customers.

The combo of well-developed people skills and personality traits make up a strength-bank, my strength-bank.

Also, my long-time friend and Art Institute of Dallas instructor, Carlos Coronado, taught me this helpful tip. Take knowledge, abilities, skills, and habits (K.A.S.H.) and put them together. It is only then I can turn them into the cash of a rewarding career move.

In short, that spells a healthy wage for my family.

Reprogram the Hill of Circuitry to Escape Unlivable Wages

Searching through the rubble of an unlivable wage’s remnants, the EMT locates the victim.

At last, your negative thinking patterns and their influence on your past actions have connections that are clear. Now, reprogram your mind. This is accomplished through the connection of new combinations of positive thoughts.

Work brick by brick to rebuild your self-esteem.

To prepare, read the book, How to Think and Grow Rich by Napoleon Hill. This work created during the Great Depression era, gives Hill, a pioneer that invented the self-help industry, the opportunity to explain in his own way that each failure holds a seed for success.

And Hill was so gifted at it because, well, he lived it. This book was his success in a string of what many critics would call failures. But after this book, none of their evaluations mattered.

He didn’t even get paid by Carnegie to write his book, Think and Grow Rich. Carnegie agreed to pay for his travel to interview the most successful people of his time.

To identify the seed of success in your career disappointments, self-nurture through morning routines. First, set yourself like a warm bath in positive thoughts.. Hill found this lead him to affirmations and visualization exercises.

In short, these self-confidence builders led to better income opportunities.

Hal’s Leaky Life Preserver

Hal Elrod’s classic book, The Miracle Morning tells his story to convince readers to adopt his lifestyle of less sleep more action.

Elrod’s story typifies miraculous, as there is proof that Hal willed himself from an invalid state to later run a marathon. Such a testimony gets readers to rethink their current sleep needs.

After all, if Hal can do it, you can do it too.

He encouraged his audience to get up an hour earlier than usual and work toward more inclusive income opportunities.

As an entrepreneur, up at 4 a.m. Hal felt energized. Using ten-minute increments, Hal would move through a circuit of activity. Through short sessions of meditation, journal writing, reading, exercise, visualization, and affirmation. Hal emptied himself of stress and anxiety to restore optimum levels of self-confidence.

Hal swore by his routine and started up the Miracle Morning support group.

Hal’s ideas were inspirational to me as well but unsustainable. I began to fall asleep throughout my workday. Still, his book reignited a flame within me to change my lifestyle. The results, as I look back, were a renewed emphasis on growth-centered habits and the creation of a self-nurturing environment.

YouTuber Amy Landino along with myself came to this same conclusion. See her video below for more information.

Fruits of Insane Labors

In search of a better career fit, you can discover many ideas to help create a fuller life.

First of all, self-care is your continuous, full-time job.

Therefore, engage in continuous self-care. Self-care needs time limits. Obligations as a father or mother and spouse may keep you from a long luxurious routine of self-care. That’s fine.

A well-thought-out plan includes meditation, journaling, visualization, affirmations, and time to read books on your self-improvement. Ten minutes or less for each activity would be a great balance. Meanwhile, flexibility is key.

As Matthew McConaughy explains, each person must define success in his own way. For me, that success is a set of balls in the hands of a juggler. I have to keep all of them up and spinning in the air. These are my successes as a husband, father, friend, writer/artist, and spiritual person.

My career is the ball right now I move to get off of my foot into the dance of my juggling act.

A continuous hour of self-care activities I’ve found to me to be unrealistic. I need patience. This allows me to fill in each activity when I can fit it in.

Likewise, you and I need exercise. Forty-five minutes of physical exercise three to four times a week is a great mix. This exercise is a stress and tension release. Finally, daily prayer needs to happen. Personally, I need to follow my prayer to a point of mastery. I’ve found it best to pray in the morning before my day starts. Right now, practice and mastery of the prayer process is my aim.

Close the Case on Unlivable Income

Black and white negatives shuffle, from atop the solid desktop, into a flimsy, vanilla, cardboard, file folder. The Super Eight film footage of a model car collision disappears.

All that’s left is a black screen. The flapping sound of an unrestrained, spiraling, film reel gives rise to the detective. He sits in silence for a while. Finally, he strikes a match and lights up his pipe, gets up, and turns off the machine.

The investigation of my lack of income has ended; however, it may leave you with unanswered questions. It’s true these ideas for solutions are untested.

As McConaughy explains, you’ve got to find what’s the right solution for you.

So, experiment with the modified self-care activities and schedules to fit your needs.

A Healthy Income Curtain Falls

Convinced of your need for change in income levels or another problem? Say goodbye to unlivable wages!

Sustainability above all is the goal. Self-nurturance is a must anytime you have an injury. You have to take care of yourself.

Consistency is the unknown. This is the environment needed to overcome your vocational obstacles or past disappointments. The success you discovered as you picked apart your crash scene comes from personal-growth-centered activities.

Believe in that. When you do, there’s more than a livable wage is around the bend.

To rise above the distractions, you need a positive outlook. In other words, this perhaps is different from mine. To drown out the noise of inaction, you need a well-thought-out plan. But you’ve got this.

Summary: Say, Farewell Unlivable Wage

If you liked this post, please share. Sign up for the Create Media Like a Pro Cheat Sheet and/or our jeffsyblik.com post alert. In that way, you’ll be the first to know when I release more tips on how to become your top-shelf you. Until next time…

As can be seen, you’ll be successful. Because success is measured in growth, not income levels. If you finally get this, your authenticity will leave an indelible mark, a watermark on your world.

Be sure and use this calculator to figure out your livable wage. Use that amount as your baseline when on your job search. If you are after clients, focus on the equivalent of this hourly number per month to avoid unlivable wages.

Now, go thrive! Any questions or concerns drop them in the comments section below.